Update, Year 2009: currently Maxa Financial offering 4.55% GIC, the highest in Canada. Big banks like TD/Scotia are offering 2.xx percent GIC! Crappy crappy crappy! Go with Maxa in 2009.

There are plenty of high interest savings accounts as of August 2006 offering over 3.5% interest all the way up to 4.5% interest.

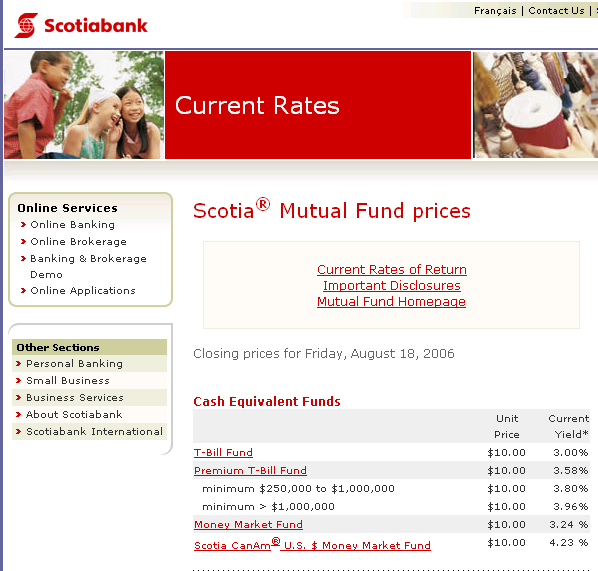

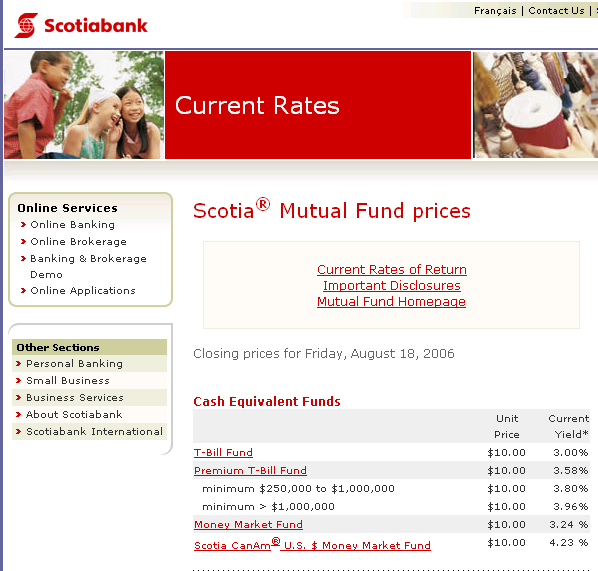

The interest rate for a t-bill or money market fund can fluctuate as high as 4.23% over at Scotia bank. Now, do you think I'm stupid?

Why the red flying fuck would anyone invest into a t-bill or money market fund at Scotia (see below picture) if one can earn higher interest on a bank account where one can have access to their money any time with no minimum investment?

Note that although the above CanAm fund shows 4.23%, that is not the actual return you get. They are showing a high point in the fund - this fund has been as low as 0.5% interest some years! That's the one catch to money market funds - the posted interest rates by the banks are a a tad misleading.

Of course ScotiaBank's own high interest savings account is only 3% (in year 2006) which is a low rate compared to the other banks offering high interest savings accounts. So it is possible the reason T-BILL/Money Market interest rates are so shitty, is because the bank thinks they are the only bank on earth - and that there aren't COMPETITORS out there who offer SIMILAR SERVICES at much better interest rates. However, even if you were comparing a ScotiaBank t-bill/money market fund compared to Scotia bank's own high interest account - it would still be naive or read stupid fund to invest into. Why would anyone put their money away and have it locked into a 3-4% t-bill/money market fund when ScotiaBank's own high interest savings account offers 3-3.3%?

Every time you get a paycheck, gift money, cash from a garage sale, etc. you could immediately dump it into a high interest savings account and start earning right away. There is no $1000.00 minimum. So earning 4.50% on ANY amount immediately, is going to earn you much more interest in the end than saving up until you obtain $1000 dollar chunks to dump into a t-bill which is at 3.25% or some other shitty rate just above or below the current high interest savings rate (usually below - considering the picture above shows a maximum of a rare 4.23% (high peak point), when in fact 4.50% is available on high interest savings account elsewhere.

Good heavens, investors are stupid fudge-nuts. Don't listen to your banker and their latest products. Do your research first - and you won't be a fudge-wad like the rest of them investors and professional money managers are.

Do we have something against Scotiabank specifically? Absolutely not! Their personal and business banking plans are good and their customer service is good. Royal bank is even worse than Scotia - offering absolutely crappy high interest savings account rates, and extremely crappy GIC rates. Only a sucker banks with RBC. Yet even Bank of Montreal is worse than Scotiabank, offering low crappy interest on their high interst savings account. This page is not an attack on Scotia only then, it is an attack on stupid investors and stupid t-bill/money market funds available at all Canadian big 5 banks. This is an attack on the naive folks (so called investors) who choose to use Scotiabank, TD, Royal, CIBC, or ANY big five Canadian bank for investing into T-Bills or money market funds.

Solution? Try Maxa Financial. Or you can check Canadian Tire bank, President's choice, Outlook Financial, Ing Direct, ICICI bank (although annoying Indian customer service at times, often they are okay).

The above Scotiabank image also has one other noteable laughter peice. The "minimum $250,000" investment for 3.80% interest rate is alarmingly shitty, considering I can get a high interest savings account for 4.10% elsewhere or a high interest savings account with 4.5% interest elsewhere, or a high interest savings account with 3.75% elsewhere. Where do these banker manager/professionals at the Big 5 banks get off? They must really jerk off their customers and take advantage of their stupidity - because if they were honest, they would tell them to get their money as quickly the fuck out of TD bank, Scotiabank, CIBC, BMO, and RBC.

This page is an attack on all T-bills, money market funds, and naive investors who place their money in such shitty interest earning portfolios. The Scotia picture above was just one example of what Canadian big 5 banks are offering. The rates at TD, CIBC, BMO, etc are of similar shittiness. So the solution is to go with Maxa Financial, Outlook Financial, Ing, Icici Bank, President's Choice Financial, Canadian Tire Bank, and other similar places.

So - what is the reason for such shitty interest rates from the big 5 banks? Obviously, the SALARIES THAT THE BANK MANAGERS AND PROFESSIONALS NEED TO BUY OREO COOKIES FOR THEIR CHILDREN IS THE REASON THEY OFFER SUCH POOR RATES, BECAUSE THEY NEED TO TAKE A CUT AND MAKE A LIVING SOME HOW. THAT'S HOW CAPITALISM WORKS. FORTUNATELY CAPITALISM ALSO ALLOWS ANY COMPETITOR TO OFFER MUCH BETTER INTEREST RATES AND BENEFITS, WHICH IS EXACTLY WHAT HAS BEEN INFAMOUSLY AVAILABLE FOR MANY YEARS AT NONE OF THE BIG 5 BANKS.

See also: Invest Your Stupidity into TD Canada Trust, Invest Your Stupidity into CIBC, Invest Your Stupidity into Royal Bank, Invest Your Stupidity into Bank of Montreal

Note: our spell checker says that we spelled Shittiness wrong and that it should be spelled Shiftiness. We're not sure that we agree. Do you?

|